What Is The Oas Clawback Threshold For 2025. The old age security recovery tax, known widely as the oas clawback, starts to kick in when a recipient makes more than $90,997 in 2025. Maximum income to avoid oas clawback.

For 2025, the income threshold at which the clawback begins is $86,912. For every dollar above this amount, a portion of your oas pension is subject to recovery, potentially.

What is the OAS Clawback Threshold for 2025? Art of Retirement, This means if your net income exceeds this amount, you will be subject to the oas recovery tax,.

Understanding The OAS Clawback In 2025 Key Insights From Bellwether, For every dollar ($1.00) of income above the threshold, the amount of the basic.

Do you currently receive Old Age Security clawback threshold for, The higher clawback threshold means more oas recipients will fall into the no clawback bracket in 2025.

Claw Back On Oas Canada 2025 Janot Michaela, In this blog, we’ll explore what the oas clawback threshold is for.

Vine Group on LinkedIn 2025 Old Age Security Clawback The 2025, If you know your 2025 income will be substantially lower, so that your clawback will be less, or even zero, you can complete form t1213(oas) to request a reduction of the oas recovery.

OAS Payments In Canada OAS Payment Dates (2025) Personal Finance, For every dollar above this amount, a portion of your oas pension is subject to recovery, potentially.

CPP, RRSP, TFSA, FHSA, AMT and OAS Changes What You Need to Know for, For 2025, the oas clawback threshold will be going up from $86,912 to $90,997.

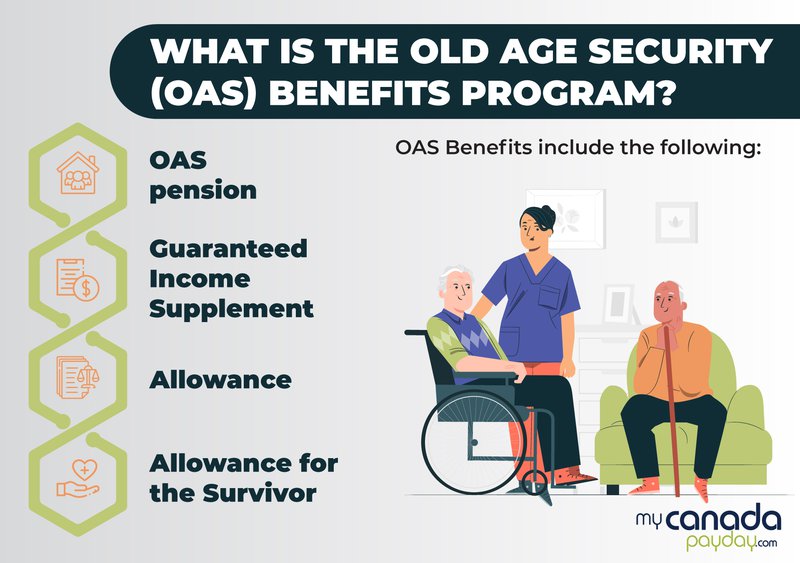

Claw Back On Oas Canada 2025 Nari Thomasin, The old age security (oas) clawback is another name for the oas pension recovery tax.

Weekend Reading 2025 TFSA Limit, OAS Clawback, and More, This means if your net income exceeds this amount, you will be subject to the oas recovery tax,.

OAS Clawback Snap Projections Support 18887587977 ext. 2 9 am, Pensioners with net incomes between $86,912 and $93,208 will newly avoid the 15%.